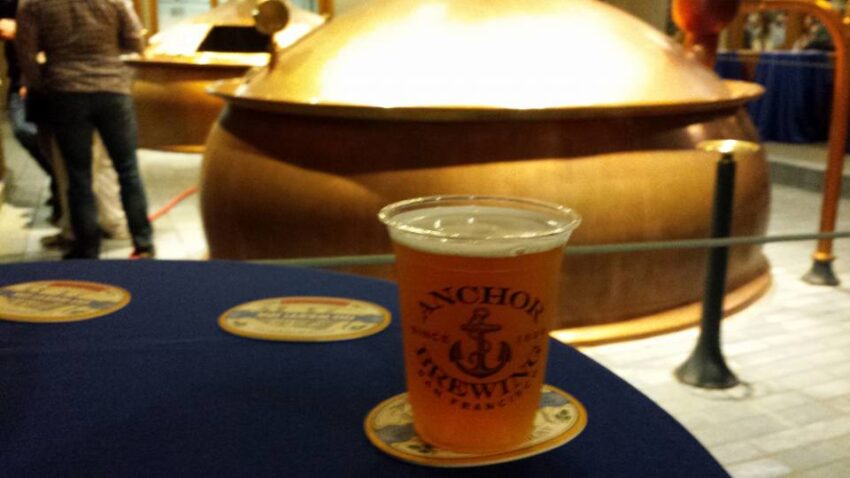

On June 10th the San Francisco Chronicle revealed that iconic Anchor Brewing Company would halt nation-wide distribution of its beers. It’s a surprising move, but understandable given the economic realities of the beer market which has seen craft beer sales slow and the sector’s market share decline for the first time in many years, at…

Category: Commentary

Misogyny in the Beer Industry

On May 11th, Brienne Allan –Production Manager at Notch Brewing, in Salem, Massachussetts– asked her Instagram followers “what sexist comments have you experienced?” The result has been an outpouring, a flood really, of messages from women (and a handful of men) sharing their experiences. In response, Allan has made her Instagram story feed ( @ratmagnet…

Not All is Yet Doom and Gloom for Craft Beer

When the pandemic hit, spurring the ensuing (and necessary) shut-downs, there was no dearth of articles predicting the doom of craft brewing, with titles such as “Coronavirus Could Kill Craft Beer” or “Will Craft Brewing Survive?” And, indeed, a survey conducted in April by the Brewers Association revealed a marked decrease in category sales, massive…

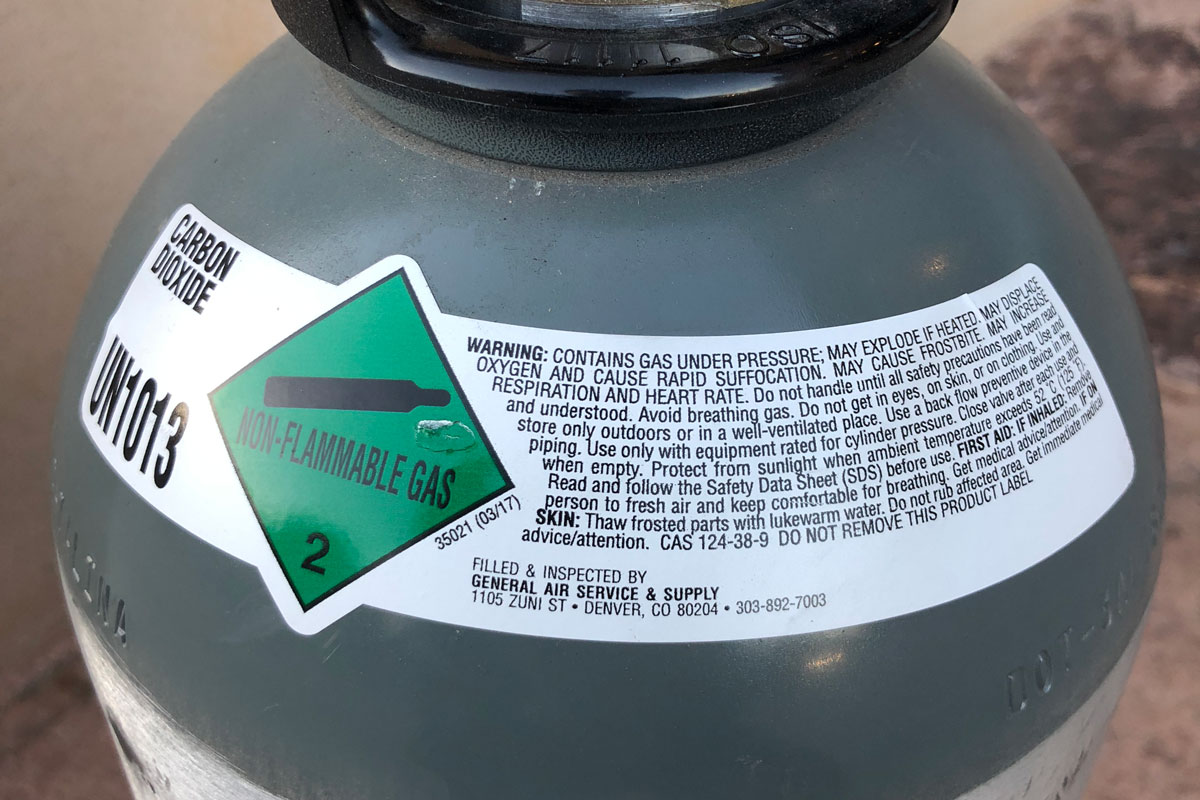

The CO2 Shortage

On April 7th the Brewers Association, along with the Beer Institute, and several other industry groups, including the Compressed Gas Association, signed a letter to Vice President Mike Pence expressing “strong concern that the current coronavirus (COVID-19) pandemic creates a significant risk of a shortage in carbon dioxide (CO2).” The letter further noted that “A…